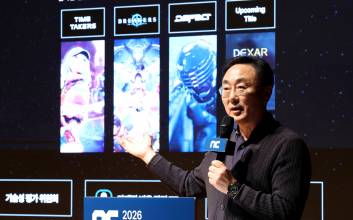

엔씨소프트가 3대 핵심 성장 전략을 추진, 2030년 매출 5조원 시대를 열겠다고 밝혔다.엔씨는 3월 12일 경기도 성남시 엔씨소프트 판교R&D센터에서 ‘2026 엔씨 경영전략 간담회’를 개최했다. 박병무 공동대표는 2026년 성장 전략과 중장기 사업 방향을, 아넬 체만(Anel Ceman) 센터장은 신성장 동력인 모바일 캐주얼 사업 전략과 실행 방안을 발표했다.박병무 공동대표는 “지난 2년은 미래 성장을 위해 기반을 다지는 시간이었다”며, 앞으로 엔씨의 성장을 이끌 3대 핵심 전략으로 ▲Legacy IP 고도화 ▲신규 IP 확보 ▲모바일 캐주얼 사업을 제시했다.엔씨는 리니지, 아이온, 길드워2, 블레이드 & 소울 등 Legacy IP의 핵심 가치를 지속적으로 강화한다. 운영 체계의 고도화, 서비스 지역 확장, 스핀오프 신작 게임 개발 등을 통해 안정적인 매출 기반을 공고히 해 나간다는 방침이다.신규 IP 발굴을 목표로 자체 개발력 강화와 퍼블리싱 사업 확장을 동시에 추진하는 투 트랙 라인업을 구축한다. MMORPG, 슈팅, 서브컬처, 액션 RPG 등 다양한 장르에서 자체 개발 10종 이상, 퍼블리싱 타이틀 6종 이상의 신작 라인업을 이미 확보했고, 구체적인 내용은 순차적으로 공개할 계획이다. 장르와 플랫폼 다각화를 통해 세대와 지역 확장을 추진한다. 지난 2025년부터 게임성 평가 위원회, 기술성 평가 위원회, 진척도 관리 TF 등을 운영하여 게임의 완성도와 시장성 확보 및 개발 기간 관리에 주력하고 있다.엔씨는 글로벌 게임 시장의 30% 이상을 차지하고 있는 모바일 캐주얼 분야를 신성장 동력으로 선정했다. 2025년 모바일 캐주얼 센터를 신설하고 ▲개발 ▲퍼블리싱 ▲데이터 ▲기술 역량을 통합한 모바일 캐주얼 에코시스템(Ecosystem)을 구축해왔다. 박병무 공동대표는 “엔씨의 검증된 데이터 분석 능력과 라이브 운영 역량에 실제 실행 경험을 갖춘 인재의 결합이 모바일 캐주얼 사업을 성공적으로 수행할 수 있게 할 것”이라고 설명했다.엔씨는 3대 핵심 성장 전략의 가치를 재무적 성과로 입증할 계획이다. 2026년 매출 2조5000억원과 의미있는 영업이익을 달성한 후 중장기 성장 전략을 기초로 2030년 매출 5조 원, ROE(자기자본이익률) 15% 이상을 달성하겠다는 목표를 공개했다.아넬 체만 센터장은 엔씨가 추진하는 모바일 캐주얼 생태계 구성과 사업 실행 방안을 구체적으로 소개했다.향후 엔씨의 모바일 캐주얼 사업은 5단계 프로세스를 통해 진행한다. ▲연간 수십여 종에 달하는 콘셉트 테스트 ▲신속한 프로토타입 제작 ▲실제 이용자 대상의 A/B 테스트 및 데이터 분석 ▲핵심 지표에 따른 광범위한 고객확보 및 종료 결정 ▲성공한 타이틀의 LiveOps(운영) 등이다.아넬 체만 센터장은 “모든 단계에서 데이터에 기반한 의사결정이 이뤄진다”며 “게임의 출시와 운영에서 매우 예측 가능성이 높은 모델”이라고 말했다.엔씨는 전략 실행을 위해 모바일 캐주얼 생태계를 체계적으로 구축하고 있다. 무빙아이, 리후후, 스프링컴즈 등 유럽, 동남아, 한국의 지역에서 글로벌 경쟁력을 갖춘 개발 스튜디오를 확보했다. 또한 최근 저스트플레이와 같은 플랫폼 기업을 인수하며 에코시스템의 핵심 엔진을 마련했다. 향후 추가적인 개발 스튜디오 인수와 퍼블리싱 사업 확대로 생태계를 키워 나갈 계획이다.모든 스튜디오는 본사가 보유한 중앙 데이터 플랫폼에 연결된다. UA(이용자 확보), ROAS(광고 효율성) 분석, LiveOps(운영), 크리에이티브 최적화, AI 관련 기능 등을 지원하는 통합 플랫폼으로 여러 스튜디오를 아우른다.아넬 체만 센터장은 “포트폴리오가 축적될수록 지속적인 성장이 가능하다”며 “엔씨는 데이터 기반의 모바일 캐주얼 사업을 실행할 시스템이 구축되었고, 이를 기반으로 고속성장 할 준비가 됐다”고 밝혔다.

![“오빠, 나 이러려고 만나?”... 한 번쯤은 공감했을 ‘그냥 필름’ [김지혜의 ★튜브]](https://image.isplus.com/data/isp/image/2026/03/03/isp20260303000042.400.0.jpg)

![“이 집에서 개가 제일 얌전”… 유튜브 ‘옥지네’가 보여주는 다정한 소란 [김지혜의 ★ 튜브]](https://image.isplus.com/data/isp/image/2026/02/22/isp20260222000072.400.0.jpg)